florida death inheritance tax

This tax is different from the inheritance tax which is levied on money after is has been passed on to the deceaseds heirs. The federal government however imposes an estate tax that applies to residents of all states.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

If you have assets in other states which do this may complicate your estate planning matters.

. An inheritance tax is a tax on assets that an individual has inherited from someone who has died. You have to pay taxes on the 100000 gain. Florida does not have a separate inheritance death tax.

Florida doesnt collect inheritance tax. An estate tax is a tax on a deceased persons assets after death. This means if your mom leaves you 400000 you get 400000 there are no taxes to pay.

An inheritance is not necessarily considered income to the recipient. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of. There is no inheritance tax in Florida because the property that is inherited does not count as income for the federal tax guidelines.

However it is important to be aware that while there is no inheritance or estate tax the executor will still have to do the following. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an. In Pennsylvania for instance the inheritance.

In 2021 federal estate tax generally applies to assets over 117 million. If the person giving them the property lived in one of the six states that do levy an inheritance tax that state would collect an estate tax. There are no inheritance taxes or estate taxes under Florida law.

For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax. This law came into effect on Jan 1 2005. 2 Inheriting at death is good because of stepped up basis.

The major exceptions are first if the money was tax deferred such as under an IRA 401 403 or Keogh plan. However the federal government does impose an estate tax that applies to all residents of all states but it only applies if the value of the estate exceeds 117 million. There is no federal inheritance tax but there is a federal estate tax.

In 2012 Mom deeds the house worth 110000 BEFORE she dies. If youre concerned about passing your property to your heirs because of taxes dont be concerned. Moreover Florida does not have a state estate tax.

22 the estate tax exemption was then increased in 200000 increments to reach 3. Florida Inheritance Tax and Gift Tax. Third Florida has no personal income tax.

There is no inheritance tax in Florida but other states inheritance taxes may apply to you. A federal change eliminated Floridas estate tax after December 31 2004. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022.

If you have 5 million or less congratulations. That money will be taxable as it is. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

Federal estate taxes are only applicable if the total estates value exceeds 117 million as of 2021. In Florida there are no estate or inheritance taxes. Spouses in Florida Inheritance Law.

The federal government then changed the credit to a deduction for state estate taxes. If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth.

Inheritance tax doesnt exist in Florida at any level. If an individuals death occurred prior to that time then an estate tax return would need to be filed. And as a general rule most inheritances will not trigger a federal income tax either although the estate may have to file a federal income tax return.

There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the. Although beneficiaries are responsible for paying the inheritance tax while estates pay the estate tax many estates step in to take this financial burden off their. Florida is one of those states that has neither an inheritance tax nor a state estate tax.

Estate taxes are paid by the estate before the assets are distributed to beneficiaries while an inheritance tax falls to the person inheriting the asset. This applies to the estates of any decedents who have passed away after December 31 2004. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40.

Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. As noted above Florida does not impose either of these taxes. Mom buys the house in 1980 for 10000.

The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the value of a single bequest. Florida doesnt have an inheritance or death tax. Thats right there is no estate tax for the vast majority of US citizens.

In Pennsylvania for instance the inheritance. Previously federal law allowed a credit for state death taxes on the federal estate tax return. Florida does not have a separate death or inheritance tax.

The tax that is incurred is paid out by the trustestate and not the beneficiaries. You may have heard the term death tax but estate tax is the legal term. Florida doesnt have an inheritance or death tax.

For example if you are a. Moreover Florida does not have a state estate tax. If the married.

Florida doesnt collect inheritance tax. Mom dies in 2012 when the house was worth 100000 and you inherit the house. If someone dies in Florida Florida will not levy a tax on their estate.

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. Florida does not have a separate inheritance death tax.

The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries. If someone dies and leaves behind a spouse who they were legally married to at the time of death the spouse is first in line to inherit everything. If there were no children either from the couple or from the deceaseds previous relationship then the surviving spouse is the sole heir.

You sell the house after she dies. However the federal government imposes estate taxes that apply to all residents. The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance.

How To Prove Funds Are Inheritance To The Irs

Inheritance Laws In Florida Explained

State Death Tax Is A Killer The Heritage Foundation

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Taxes In Florida Does The State Impose An Inheritance Tax

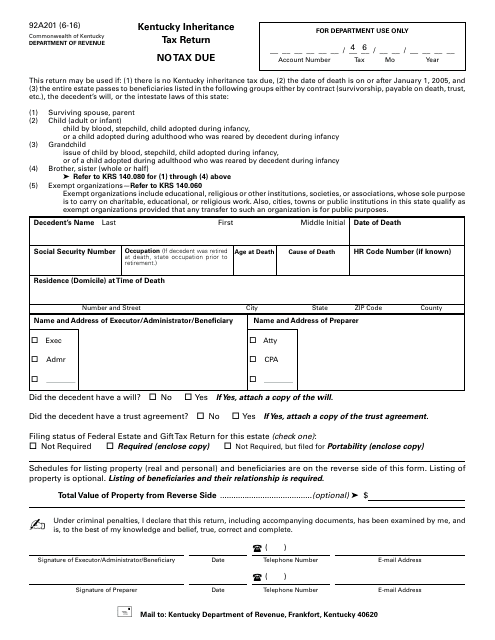

Form 92a201 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return No Tax Due Kentucky Templateroller

U S Estate Tax For Canadians Manulife Investment Management

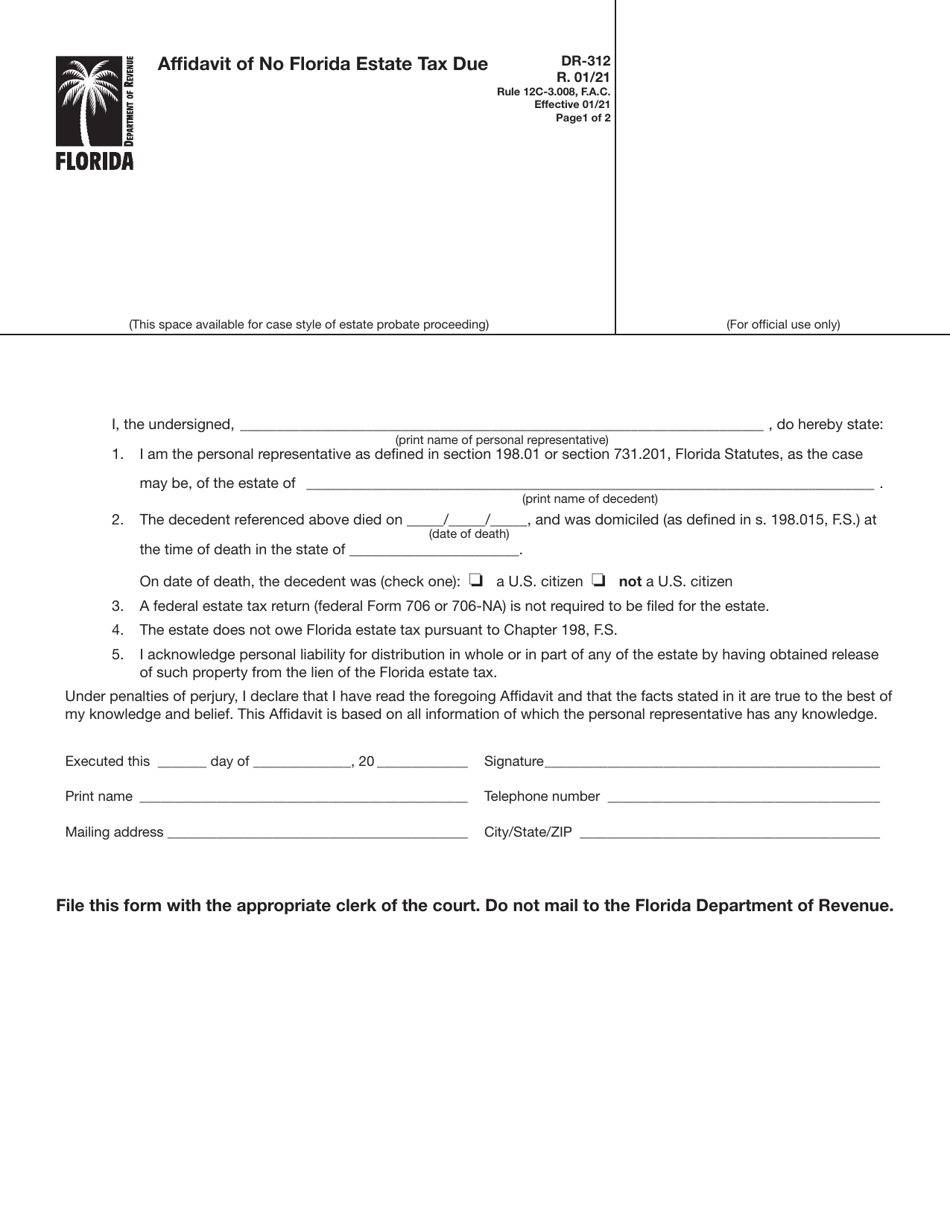

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Attorney For Federal Estate Taxes Karp Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

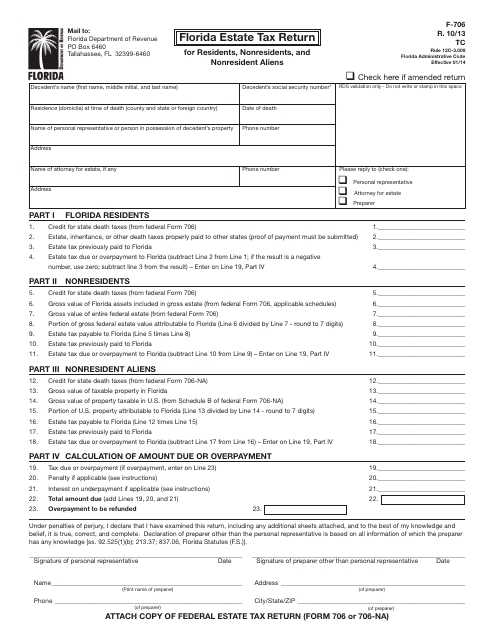

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Eight Things You Need To Know About The Death Tax Before You Die

Florida Inheritance Tax Beginner S Guide Alper Law

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate Tax Rules On Estate Inheritance Taxes

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller